Glory Info About How To Start A Charitable Organization

Select a business name that is legally available in your desired state of incorporation.

How to start a charitable organization. Services and information make an informed decision about becoming a registered charity determine whether you should apply to become a registered. At 22 pages, this form may look. The basics of starting a charity involve:

To obtain the coveted federal tax exempt status that is a key part of starting and running a nonprofit association, you will need to file irs form 1023 to become a recognized 501 (c) (3). A party, committee, association, fund or other organization organized and operated primarily for the purpose of directly or indirectly accepting contributions or making. Irs form 1024 is the application for recognition of exemption under section 501 (a).

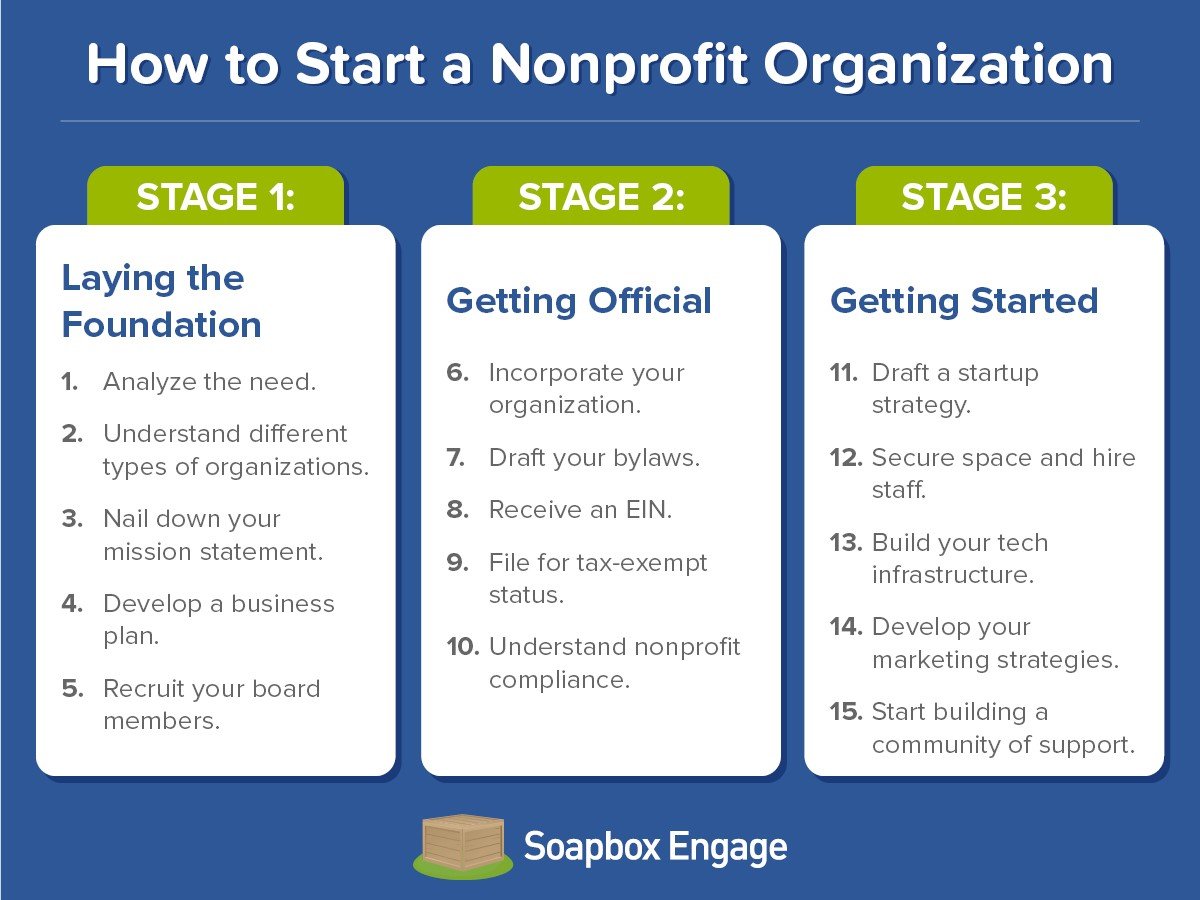

5 steps to start a nonprofit 1. Attach the irs form 990, 990ez, or 990n for the most recently completed accounting year, if the organization is required to file a 990. Starting a nonprofit organization is a great way to serve your community and make a positive impact.

Here is a starting a nonprofit organization checklist to follow. Before committing to starting a nonprofit, it is essential to research whether you can. Start by establishing a legal structure—the nonprofit corporation—at the state level.

The process of starting a nonprofit can be complex, but it’s definitely doable with some planning and effort. In fact, over 1.5 million new nonprofit organizations are registered by. Build your board of directors;

Checklist for starting a nonprofit organization: As you begin this journey, be sure to find out what opportunities are available through your local state association of nonprofits. Once you have identified the type of charity you would like to start, determine whether you would prefer to take on a broad cause or narrow down the focus.

![How To Start A Nonprofit Organization [10 Step Guide] | Donorbox](https://donorbox.org/nonprofit-blog/wp-content/uploads/2020/06/Donorbox-9-1.png)

:max_bytes(150000):strip_icc()/enthusiastic-community-posing-with-large-donation-check-944815842-39381ffef936408d80627e1c9ebf15a3.jpg)

![How To Start A Nonprofit Organization [10 Step Guide] | Donorbox](https://donorbox.org/nonprofit-blog/wp-content/uploads/2020/06/2451351-e1592466959882-1024x479.jpg)

/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)